The MUSCLE Method ®

Evaluating the Underwriter

The bottom line: The IPO underwriter knows the company better than almost anyone. That investment bank gives you an implied endorsement for the IPO. When they sell the deal, it’s their reputation on the line.

Where does the underwriter fit into the IPO process?

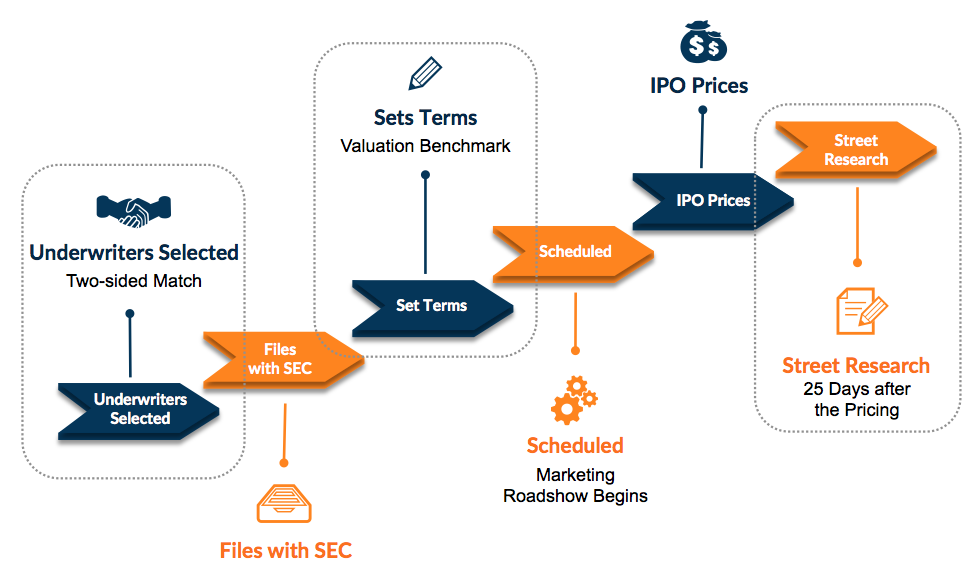

A company kicks off the IPO process by selecting an underwriter.

Next, the company, underwriter and lawyers file a prospectus with the SEC.

The IPO marketing process begins when a company publicly announces its IPO terms. These include the number of shares to be offered and the proposed price range.

Then the underwriters tell their institutional investor clients the exact date they expect to price the IPO. This pricing date is usually not announced to the public.

The underwriter then prices the deal, based on the orders they receive. The IPO finally begins trading and 25 days later the underwriter issues its first research report. The 25 days without research is called the “Quiet Period.”

The IPO Match Game

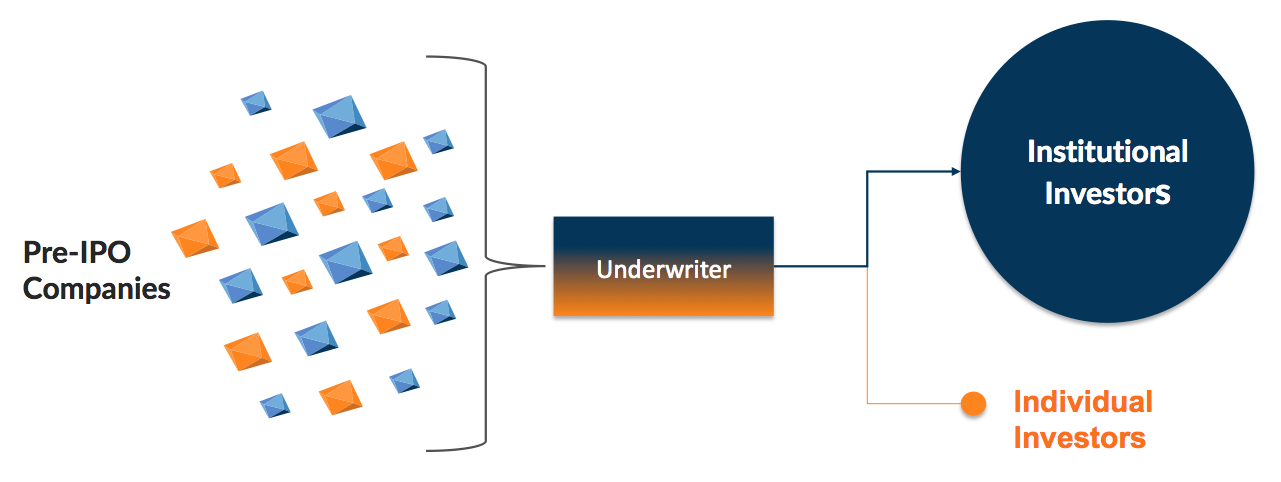

It’s important to understand how the company and the underwriter get together.

The process begins with the underwriters calling on private companies trying to solicit their business to take the company public.

Before the underwriter agrees to take a given company public, there is a very thorough vetting process done by the underwriter to assess the company.

The underwriters know that their reputation is on the line with every IPO they do. If they bring out a dog, their institutional clients who buy the deal WON’T be happy.

So here is the key, when the investment bank underwrites an IPO it is giving an implied endorsement of the company, signaling to the investors “we like this deal.”

They actively market the deal in roadshows and one-on-ones with larger institutional investors.

So as an investor, you need to evaluate the underwriters’ track record to determine if you should trust their "implied endorsement."

What should I look for with an underwriter?

Find out: How many deals have they done? Are they active? The more deals, the better!

How have their deals been performing? We recommend you look at the performance of the underwriter’s IPOs during the first 90 days of trading. That is a decent time to evaluate how well the underwriter prices their IPOs.

Compare underwriter activity easily by going to the underwriter screen on IPO Pro. You can look at all underwriter activity, or drill down to focus on the underwriter of the IPO you’re interested in.

Where is the Underwriter on IPO Pro?

Every profile, and within our Underwriter screen.

Every profile has a QuickTake box. This box is from Twilio’s profile.

We link to a pre-populated screen of the lead underwriter, so you can know exactly how many deals they’ve done in the past year, and how those deals have performed.