The MUSCLE Method ®

How Institutional Investors Uncover Winning IPOs in Half the Time

There’s a reason why institutional investors dominate the IPO market. They understand the tremendous profit potential of IPOs and know how to determine which IPOs have the highest probability of success quickly.

Sure they have lots of money and strong relationships with underwriters that give them a leg up on most investors. But probably the most prominent myth in IPO investing today is that the Big Boys only make money by getting coveted IPO allocations.

The reality? They never get enough IPO allocations, so they use a proven and time-tested process to analyze deals and fill out their IPO position in the aftermarket.

We’d like to share that process with you.

A Proven Method to Increase Your IPO Profits Without Spending More Time & Effort

When it comes to IPOs, most investors are OPPORTUNISTIC – typically buying a hyped-up deal or one recommended by their financial advisor or friend.

They don’t have the resources or time to distinguish good deals from bad. However, the real money in IPOs is made using a comprehensive approach that considers EVERY IPO and then picks the very best.

Institutional Investors (Hedge Funds, Mutual Funds, Alternative Asset Managers, Pension Funds, RIAs, etc.) take a much more STRATEGIC approach to IPOs. They use IPOs to outperform the market, boosting their portfolio returns by investing in new companies before they become a household name.

Institutions know that to be successful with IPOs, you can’t just look at them singularly, you have to vet them all to find the diamond in the rough.

Our Clients Invest Hundreds of Millions of Dollars In IPOs Each Year

What I’m going to show you is not based on theory – this system is the result of decades of experience, thousands of IPOs and millions of dollars invested.

We co-founded Renaissance Capital over 27 years ago with the simple mission to help investors profit from IPOs. Since then, we have analyzed 11,753 IPOs and counting.

Renaissance Capital’s clients include the world’s largest and most active IPO investors and are considered the “Who’s Who of IPO Investing.” Each year they invest hundreds of millions of dollars on IPOs. Our clients include:

How YOU can get better IPO results while dramatically reducing your time and effort.

Once you understand the approach used by the “Smart Money” to evaluate IPO investments, you can dramatically shorten your analysis time. The key is understanding their system to prioritize certain IPOs for a deep dive analysis and reject others early on.

Knowing that a good IPO can come from anywhere, institutional buyers look at every deal. Their approach quickly weeds out low potential prospects so that they can focus their time, effort and money on only a select few.

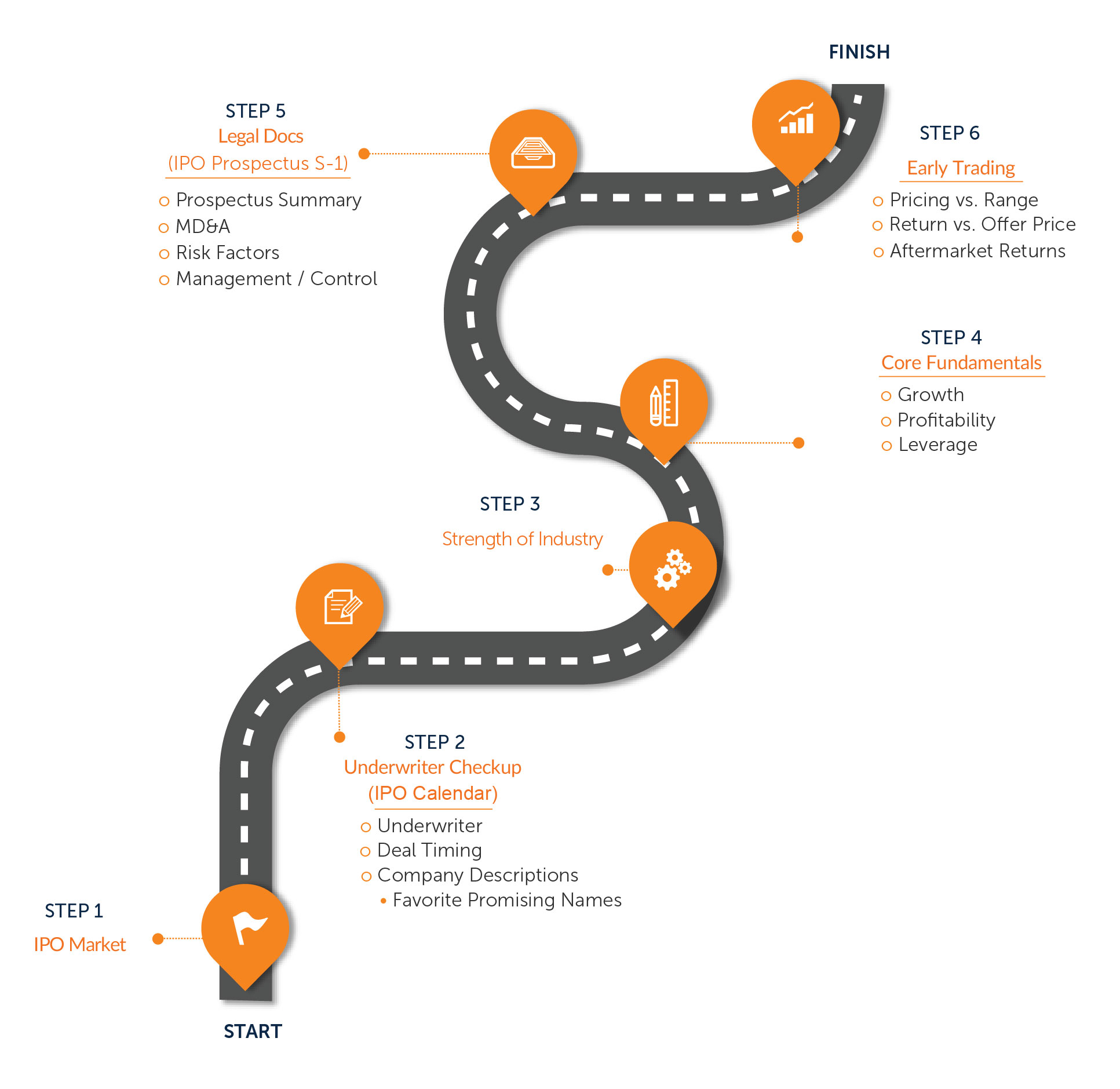

In the pages ahead we’ll walk you through the IPO investing process used by the pros. We call it the MUSCLE Method. The MUSCLE Method is an acronym, short for the IPO Market, Underwriter, Strength of Industry, Core Fundamentals, Legal Docs and Early Trading.

Introducing the MUSCLE Method

Do not spend the same amount of time on every IPO. When you follow the MUSCLE Method approach, you will find that you can narrow down your IPO shopping list in a matter of minutes. That way you can focus your valuable time on higher-potential targets.

These articles will take you through the MUSCLE Method from start to finish, so let's begin with M, analyzing the IPO Market